Fragility of the global supply chains: How is the supply process functioning during the pandemic?

05.04.2021The coronavirus pandemic serves as a stark reminder of just how vulnerable global supply chains are. Lockdowns in countries all across the globe brought production plants to a standstill, while deadlocked transport routes reduced capacities for intercontinental air and sea transport in particular, catching many industrial companies completely off guard. But not the technology company Hamilton Bonaduz AG, which is situated in the Chur Rhine Valley (Bündner Rheintal).

Global demand for Hamilton’s ventilators, laboratory robots and other life science solutions went through the roof during the coronavirus pandemic. So how did the company manage to maintain its delivery capacities? CEO Andreas Wieland gives an interview with Daniel P. Bachofen

What do innovation, management and making Salsiz (dried sausage from Graubünden) have in common? A great deal! They are all an art and will never be achieved or made successfully by simply “bumbling around”.

Daniel P. Bachofen: In early 2020, we realized that the virus had not been contained in China but had also reached western Europe. What were the first thoughts that went through your mind back then?

Andreas Wieland: The worldwide spread of Covid-19 did not take us by surprise. Even before Christmas of 2019, discussions I had been having with business partners in China in the fields of virology and blood bank management had indicated that a major storm was heading our way. My experience told me immediately that this would lead to bottlenecks in procuring components from Asia.

DB: What actions did you take?

AW: From the very start of the year, I instructed my staff to purchase materials on a large scale. We virtually covered the requirements for half a year in one go. These measures gave us a considerable advantage over our competitors. Many of our rivals failed to realize how serious the situation was until it was almost too late. In this respect, I should point out that we are not newcomers to our line of business. We were able to draw upon experiences from previous pandemics, such as SARS-CoV-1, and we were aware of the concomitant risks, including in terms of how supplies could be affected.

DB: Generally speaking, did the industrial companies in the west underestimate the vulnerability of global supply chains and their dependency on Asiatic procurement markets such as China, or did they knowingly accept the risk of disruptions to the production of components, or of blockages and restrictions in transportation?

AW: People should actually have learned from experience. I can remember the eruption of the Iceland volcano in 2010, which largely paralyzed international air traffic. Maybe some companies did not give much thought to it at the time. There is a tendency to purchase from places where prices are low and the necessary supply capacities are available. The risks are readily ignored. Many companies are now painfully learning what the consequences of that can be.

DB: On the key word of risk – pandemics are one risk, and cybersecurity is the other. In your view, how great is the risk that supply chains could be compromised or even interrupted by hacker attacks?

AW: The risk is real and fairly big. We are making a huge effort to ensure IT security. It doesn’t necessarily have to be hackers – the pandemic showed us that the importance of cybersecurity can hardly be overestimated. For example, disruptions to IT systems and networks could mean that no one knows exactly where transport containers are located, or that large forwarding companies can no longer function. Indeed, we have become very vulnerable.

DB: What specific experiences have you had in this respect during the current crisis?

AW: At the start of the pandemic, we did not experience any difficulties because we had made early provisions. Later on, we found that supplies from China had ground to a halt because the air routes were suspended, the railroads were overloaded, and trucks were being held up at the land borders. The situation was exacerbated for us because we sometimes purchase medical materials, which our suppliers were suddenly no longer allowed to export. That proved to be a bit of a headache for us.

DB: Were the official restrictions that were placed in your way more or less the same?

AW: That was very varied. For example, we purchase large quantities of printed circuit boards and other electronics from Sri Lanka. The state had ordered a complete halt in production there, a lockdown in other words. This placed the production of ventilators in acute danger. Since these products were systemically relevant goods, Swiss Federal Councilor Cassis personally intervened with the Sri Lankan government on our behalf. The ban was lifted. We received the same support vis-à-vis the Indian procurement market with the same result.

DB: There were also global bottlenecks in the supply of chips, which were in hot demand. Were you affected by that?

AW: We had taken early action once again, as early as the autumn of 2020. I was convinced that demand from the automobile industry for semi-conductors would soar once the pandemic abated. So we started purchasing electronics hell for leather, despite the risk that we would end up with surpluses. Taking such steps required some entrepreneurial courage. But the greater risk would have been to do nothing and end up getting stuck in procurement bottlenecks. If we have too many materials in our warehouse, we will still need them in six months’ time.

DB: What other measures have you taken to avoid bottlenecks?

AW: We will certainly be procuring more on a regional basis once again, i.e. from within Europe. We also had partners who exploited the situation and increased their prices, so we have ceased collaborating with those.

DB: Have you detected a trend towards local procurement and/or local manufacturing in Switzerland?

AW: As far as we are concerned, the road is leading in that direction. For example, we are going to start producing plastic parts, which had previously been manufactured for us in Italy, at our second site in Domat/ Ems. Another issue is consumable parts, which we might have to deliver at short notice at any time. To that end, we have constructed a production facility in Switzerland, and we’re about to do the same close to our plant in the USA.

DB: Doesn’t local production mean higher costs?

AW: On the contrary, in some cases the costs have shrunk massively. We are fully set on automation. To achieve this, we have highly qualified engineers in Switzerland and an excellent infrastructure. Moreover, it is cheap to borrow money at present, which is a further incentive to invest.

DB: With the global spread of Covid-19, the demand for ventilators shot up. You were inundated with inquiries and orders. Based on the laws of the market, you could have massively ramped up your prices.

AW: We didn’t charge an extra penny. We deliver our medical devices to wherever they are needed most urgently. Our criteria included, for example, the infection and illness rates, or the condition of the healthcare system. There were governments and embassies that tried to intervene with us, and in some cases brought some pressure to bear, but we were able to parry the demands with the argument that we were prioritizing help for where it was needed the most.

DB: On December 30, 2020, an article appeared in the Swiss daily newspaper, Neue Zürcher Zeitung (NZZ), which claimed that the number of ventilators manufactured worldwide had shot up five times in the past year and would then fall by a factor of ten in 2021, to approximately 30,000 to 40,000 devices. It would take three to five years for the excess supply to be used up. Is that also the way you see it?

AW: It is necessary to draw a distinction. The pandemic primarily drove up demand for low-cost ventilators. So all of the suppliers manufactured low-cost ventilators. We did too – but we didn’t confine ourselves to just that. Hospitals with high requirements are requesting high-quality machines. We met this requirement early on and had already begun production of high-end devices by April 2020. That led to a massive expansion in our customer base. So this market remains interesting. Moreover, during December 2020 and in the first month of this year, we achieved roughly the same ventilator sales figures as we did from December 2019 to April 2020.

DB: Are the devices you produce for Covid-19 treatments based on traditional, technical concepts or are there new developments involved?

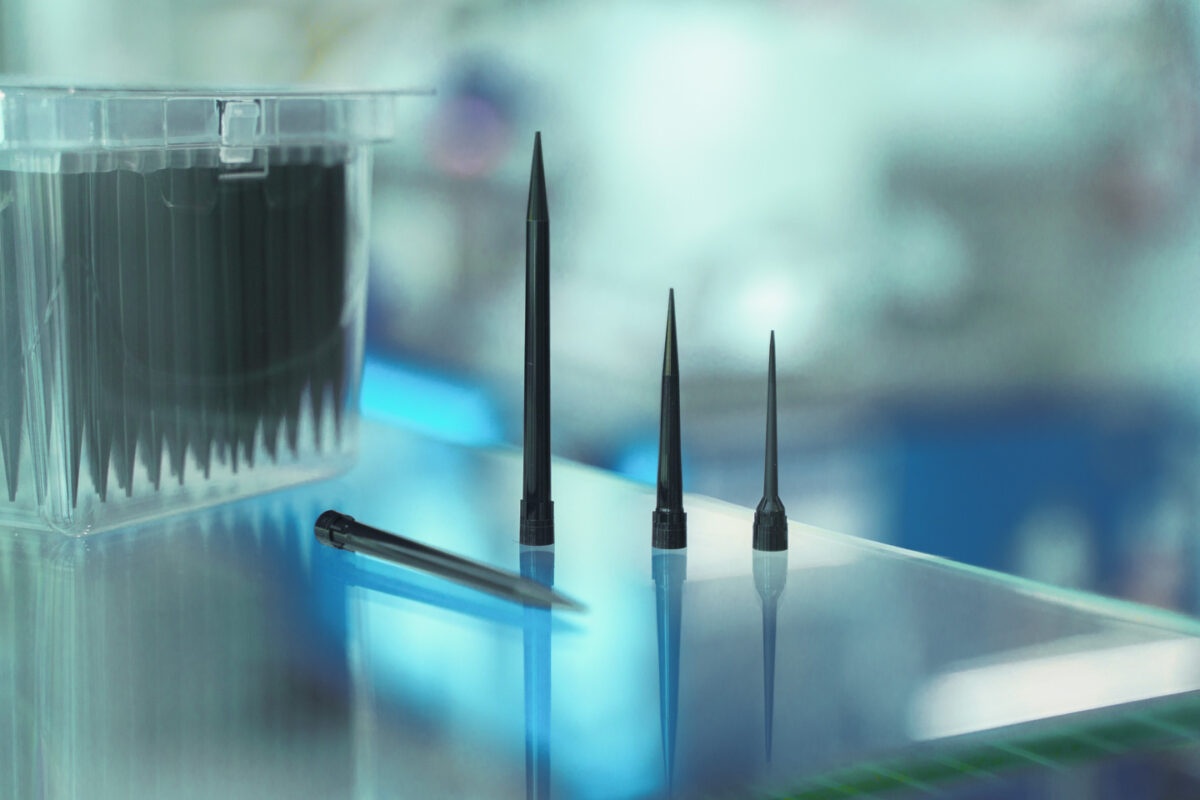

AW: For us, the pandemic triggered an initial impulse for product development. As I mentioned, we had recognized the situation by as early as the start of 2020, and we initially supplied the market with low-cost devices. Then we said to ourselves that testing devices would be needed, and so we swiftly launched two new automated, assay-ready pipetting machines for rapid high-throughput testing. Around 60% of Covid-19 tests are performed using Hamilton devices. Following this line of logic, we then focused intensively – and once again at an early stage – on the issue of vaccines and we now supply process sensors that are needed for vaccine production. We also foresaw the emergence of the mutant strains, which can be identified and sequenced with high efficiency thanks to the devices that we produce.

DB: Is remote access to your devices for monitoring and maintenance – for example in hospitals – something you are looking at, or would that be problematic in view of the need to protect sensitive health data?

AW: We are already working with machine learning, algorithms and big data analytics – to facilitate pattern recognition, for example. We are doing this with the aim of enabling the best possible treatments for the patients. We definitely want to be at the forefront of the digital revolution. Even today, every Hamilton device is linked to the internet, without exception. This gives us data sovereignty. When it comes to hospitals, whoever controls the data will leave their competitors behind.

DB: In order to meet the huge demand for Hamilton devices, is your company operating in 24/7 mode?

AW: At Hamilton, there are indeed areas where we have to extract the maximum from our infrastructure. But we also have to consider the fact that, during this pandemic period, we want to have as few staff as possible on site at the plant simultaneously and we need to ensure social distancing. Thanks to the flexibility of the cantonal authorities, we were granted a permit for Sunday work within a very short space of time.

DB: Mr. Wieland, what’s coming next for Hamilton?

AW: We are primarily anchored in the healthcare sector. Ventilation will remain a long-term theme, given that air pollution is unfortunately causing more people to suffer breathing difficulties. What’s really exciting for us is also the field of DNA analysis, which is used, for example, in medical research and pharmaceutical research, as well as in very different areas such as police investigations. If we think beyond healthcare, the food production industry could offer interesting application areas for Hamilton technologies. People will always need to eat. We are also active in the environmental sector, more specifically in the areas of air and water analysis as well as oxygen measurement – these are all issues with a long-term perspective.